Ripple Debuts RLUSD Stablecoin with Former RBI Chief Raghuram Rajan on Advisory Board

This week, Ripple launched its RLUSD stablecoin, pegged 1:1 to the US dollar. Advisory board member and former RBI governor Raghuram Rajan noted that stablecoins could soon play a key role in private payment systems.

Following Donald Trump's win in the 47th US elections, the crypto industry has seen a rise in valuation, anticipating pro-crypto reforms in the coming months. Leveraging this wave of optimism, Ripple has launched its own stablecoin, RLUSD. The US-based fintech company behind the XRP cryptocurrency introduced RLUSD as a stablecoin pegged 1:1 to the US dollar, making 1 RLUSD equivalent to $1 (roughly Rs. 85).

Stablecoins are cryptocurrency tokens backed by reserve assets such as gold or fiat currencies like the US dollar. Prominent examples include Tether, USD Coin, and Binance USD. Unlike independent cryptocurrencies like Bitcoin or Ether, stablecoins are less susceptible to market volatility due to their asset backing, making them a reliable option for both short- and long-term investment.

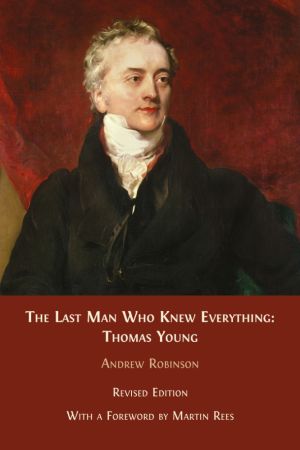

The launch of RLUSD marks Ripple's entry into the stablecoin market. To support the RLUSD ecosystem, Ripple has established an advisory board to oversee the RLUSD ecosystem and provide strategic, regulatory, and operational guidance. Among its notable members is former Reserve Bank of India (RBI) Governor Raghuram Rajan, alongside other prominent advisors.

Talking about the future of stablecoins, Rajan indicated that these tokens could soon become an integral part of private payment systems.

“Stablecoins could become the backbone of private payments by offering a secure, scalable, and efficient alternative to traditional systems. Joining the Advisory Board provides me an opportunity to counsel RLUSD in the rapidly evolving financial landscape,” Rajan said in a statement.

Raghuram Rajan served as the RBI governor from 2013 to 2016, a period during which the central bank adopted a cautious stance toward the crypto sector. Under his leadership, the RBI issued its first official warnings to the public about the potential risks associated with these highly volatile virtual assets.

Earlier this week, Ripple posted more details about its advisory board on X.

In addition to Sheila Bair, David Puth and Chris Larsen — the Ripple stablecoin Advisory Board welcomes:

:arrow_right:Raghuram Rajan (former Reserve Bank of India Governor)

:arrow_right:Kenneth Montgomery (former First VP and COO, Federal Reserve Bank of Boston)

A team like no other.— Ripple (@Ripple) December 16, 2024

Ripple's Outlook for RLUSD

This month, the total valuation of the stablecoin market exceeded $200 billion (roughly Rs. 17,01,256 crore) for the first time, according to data by DefiLlama. Joining this growing ecosystem, Ripple's RLUSD stablecoin is now live on Ethereum and related blockchains, as well as the XRP Ledger.

In the coming days, RLUSD will be launched on platforms like Bitso, MoonPay, and CoinMENA, with additional listings planned on other crypto exchanges.

Ripple aims to leverage RLUSD for large-scale international settlements for its enterprise customers. The stablecoin will also be promoted as a liquidity tool for remittance payments.

Since its inception in 2012, Ripple Payments has processed over $70 billion (roughly Rs. 5,95,474 crore) in transaction volume, offering services across more than 90 payout markets.

)